The Single Strategy To Use For Short Term Loan

Table of ContentsSome Known Details About Short Term Loan Short Term Loan Can Be Fun For Anyone6 Easy Facts About Short Term Loan ExplainedHow Short Term Loan can Save You Time, Stress, and Money.The Of Short Term LoanThe 20-Second Trick For Short Term Loan

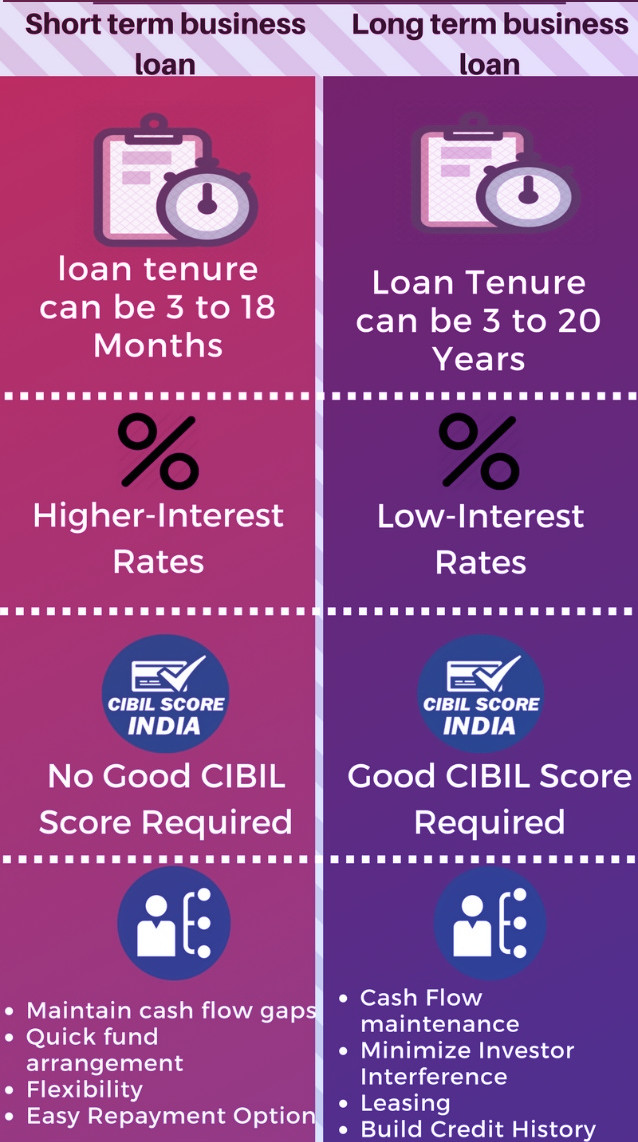

Generally, long-lasting fundings are taken into consideration much better than short-term financings. Using for numerous short-term loans can quickly get you unfavorable credit history ratings making it harder for you to gain access to lendings additionally.Banks in South Africa offer numerous kinds of short-term loans. Thesefinacal establishments customers to borrow funds for personal or service experience. South African deal short-term financings like online finances, overdrafts, as well as on the internet financings to browsers. Here are a few of the financial institutions providing short-term finances in SA: As we saw you can access instant, temporary car loans in South Africa.

For circumstances, you can obtain online financings, overdrafts, and advanced salaries from the majority of financial institutions in SA.

When you remain in a money problem, as well as you require a quick injection of cash to take care of some unintended monetary circumstance you need to be able to find a loan that can smooth over that period and one that you can leave as quickly as you're back on your feet.

Short Term Loan Things To Know Before You Get This

As the name recommends, a short term loan is a financial tool issued by a financial institution or a credit carrier that provides you cash money quickly, which you pay back with interest over the short term. Typically this period can last anywhere from a week to a few months, depending on the lending.

Once your funding is accepted, you'll get money to place towards whatever you need it for. You aren't locked into long-term agreements that can intensify the interest you're billing. They are especially designed to be concise. Commonly, your rates of interest will certainly be a bit much more reasonable because you're only borrowing cash for a brief period.

Maybe there is another way to postpone the payment and also resource the money via something aside from debt? If that holds true, then you need to consider it initially prior to resorting to a financing. The financing you pick must be straightened to whatever you're going to use the money for. So make sure that the expense is of a temporary nature before you get a short-term car loan.

You'll after that obtain a quote that discusses the costs, rate of interest price and expected payment per month based on your client account. If you are pleased with the estimated terms, be sure to read all the terms as well as problems before accepting the offer.

The 7-Minute Rule for Short Term Loan

We mentioned it above, however you're going to need to select between various suppliers to find the ideal offer for you. While it is feasible to do all this research study on your own, it can be quite laborious, as well as you will not recognize for certain that you're obtaining the ideal option.

The distinction is that you normally have much less than a year to pay off what you owe instead of a number of years, although some short-term choices might give you up to five years to repay the financial debt. The most typical types of short-term organization car loans are term fundings, lines of credit rating, and billing factoring.

And depending upon your requirements, we consisted of lending institutions with a series of settlement terms, from simply a couple of months to a couple of years.

Short Term Loan Things To Know Before You Get This

There is no collection amount of Brief Term Advantage Advance you can get. Just how much you get relies on: Your personal allowance as component of the benefit you have actually declared, as well as The number of days you have actually been due that benefit. If you are currently making repayments for previous Social Fund lendings or Short Term Advantage Breakthroughs, then these may be considered.

You need to have the ability to pay off the development within 12 weeks. A Brief Term Advantage Breakthrough is treated in the same way as a payment of the benefit you have actually made an insurance claim for so it might be consisted of in the Benefit Cap, which limits the complete amount in some benefits that people of working age can get.

A Brief Term Benefit Breakthrough will be paid directly right into your financial institution or structure society account or with the Settlement Exemption Service if you are not able to open up or take care of one of these or a comparable account. It is a funding which you need to revoke your future advantage settlements.

Upon authorization, you may discover the funds can be transferred within a short time framework, potentially much less than 24 hr. If you require particular funds fairly quickly, there are a number of choices readily available from certain debt suppliers. These might differ relating to the terms, such as the duration, interest, fees, and finance amounts.

Fascination About Short Term Loan

The amounts concerning such loans will typically be smaller sized. Or else referred to as a) financing, this is a versatile temporary financing remedy.

And depending on your needs, we consisted of Discover More lending institutions with an array of settlement terms, from simply a couple of months to a couple of years.

There is no set amount of Short-term Advantage Breakthrough you can obtain (Short term loan). Exactly how much you get depends on: Your personal allocation as component of the benefit you have asserted, as well as The number of days you have scheduled that advantage. If you are already making repayments for previous Social Fund lendings or Short-term Advantage Developments, then these may be considered.

You need to be able to repay the breakthrough within 12 weeks. A Brief Term Benefit Breakthrough is dealt with similarly as a settlement of the benefit you have made a case for so it may be consisted of in the Benefit Cap, which restricts the overall amount in some advantages that people of functioning age can get.

Excitement About Short Term Loan

A Short-term Benefit Advance will be paid straight right into your bank or structure culture account or through the Payment Exception Solution if you are not able to open up or handle click to read among these or a comparable account. It is a car loan which you need to revoke your future benefit repayments.

Upon authorization, you might find the funds might be moved within a short time framework, potentially much less than 24 hours. If you need specific funds rather quickly, there are several alternatives available from specific credit history providers. These may vary relating to the terms, such as the duration, passion, fees, as well as finance quantities.

The quantities regarding such car loans will normally check it out be smaller sized. Due to this, the approval of lendings is relatively quick and may be gotten perhaps within the hour. Or else referred to as a) lending, this is a flexible short-term financing service. This may act very similarly to a credit score card financing.

Comments on “A Biased View of Short Term Loan”